Blog | Development and Land | Permitted Development | Residential Development Consultancy

Large scale commercial to residential conversion via Permitted Development – it’s back, is it the same as before?

A decade on are we back to the 2013 hay days of large scale office conversions?

A question I have been asked several times over the last couple of weeks since the government's announcement and something that I’ve been advising clients to keep their eye on since 24th July 2023 when the government first launched their consultation on the matter with little fanfare.

So where do we stand?

Well it’s reasonably safe to say that the 250 sq ft apartments with a significant lack of natural light parked in the middle of a noisy industrial site are unlikely to make a re-appearance. Since 2021 there has been legislation requiring new Permitted Development (PD) conversions to have adequate natural light, comply with minimum space standards and have consideration of noise and residents fire safety.

This means that a new one bedroom flat with a shower room created under PD is required to be a minimum of 37 sq m and is required to have adequate natural light. However over and above this, as my residential investment colleagues have seen in recent years, while the early PD conversions comprised a significant amount of poor quality housing which was challenging to sell to investors unless delivering strong double digit yields (even in the low interest rate environment we were historically in), the more recently completed schemes are increasingly being designed to a high specification and are more akin to a new-build Build to Rent (BTR) development. They also benefit from being 100% private and therefore peak the interest of the more institutional investors.

The built environment we live in is different from a decade ago, it’s different from five years ago. ESG is now increasingly at the top of investors and governments minds. Following the adoption of the London Plan in 2021 there is a new emphasis on whole life carbon impacts and the circular economy. This means that the GLA and Councils have begun requiring that the re-use and refurbishment of existing buildings be the default assumption and that demolition and redevelopment require rigorous justification. Whole life carbon from a national perspective is now on the government and council’s minds and the recent changes are clear evidence of this.

So what’s changed?

Well for those of you familiar with the General Permitted Development Order (GPDO) Class MA rules that were brought in on 31 July 2021 (to replace the old GPDO Class O - B1 Office to C3 Residential conversion rules, that had been in place since 2013) to allow the conversion of any property in Use Class E (shops, offices, restaurant, café, gyms, leisure etc) the rules are essentially the same, with two key differences, as of 5th March 2024:

- No size limit (the 1,500 sq m maximum floor space limit has been removed).

- The property is not required to be vacant (the three month vacancy requirement has been removed).

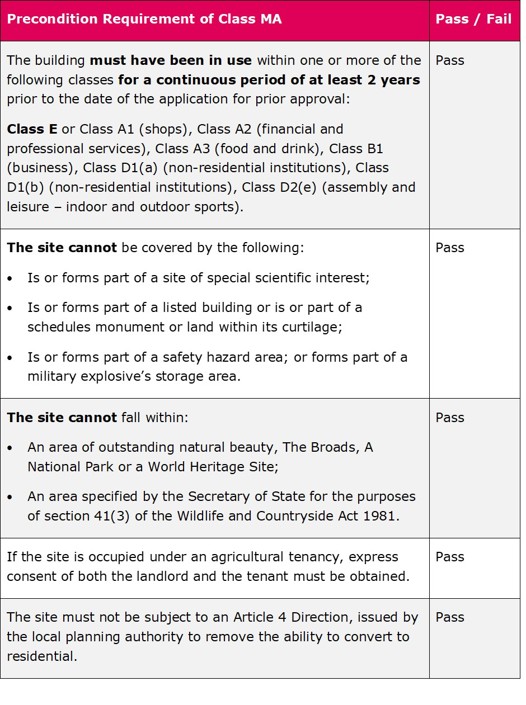

The removal of the upper size limit will be a significant boost at a time that secondary commercial property is facing major challenges. It’s worth noting another key difference, this is not just for offices like the old GPDO Class O was, GPDO Class MA applies to all buildings in Use Class E, with a number of exceptions of course. For ease I have outlined a tick box test below for your consideration.

If your property passes all of the above tests then conversion should be possible, subject to the application to the local planning authority for a determination as to whether prior approval is required for;

- Transport

- Contamination

- Flooding

- Impact of Noise from commercial premises

- Impact the change of use has on the character and sustainability of the conservation area

- Provision of Adequate Natural Light in all habitable Rooms

- Impact on intended occupiers if in an industrial location

- Impact of losing a nursery or NHS health centre

- Fire safety impact on intended occupant (in building over 18m/7 storeys)

Get in touch

If you suspect that your building may have the potential to convert to residential via permitted development and you’re considering a potential disposal strategy and want to understand the potential value implications, then please don’t hesitate to get in touch with myself or one of my colleagues we would be happy to give you our thoughts.

Related Insights

Northern Residential Property Transactions 2024 & Market Update

Take a look at the properties we sold in 2024 and read our market updates.

Allsop appoints senior land & development specialist bolstering residential and living team

Allsop has appointed Hugh Bushell as Senior Associate to its Residential Transactional and Living Markets (RTLM) team.

The Developing Relationship between Traditional Housebuilders and Single-Family Housing Investors

Looking forward there is a palpable sense of optimism within the industry. Despite the challenges that have arisen, particula...

Podcast: The return of Permitted Development – what we have learnt and what does the next cycle look like?

In this podcast episode we discuss the legislative changes to “PD” in early March. We reflect on how it has evolved to provid...