Blog | Build to Rent | Letting and Management

Stability in the Residential Rental Market

In the current uncertain macroeconomic environment, the steady growth and stability of the rental housing sector presents an appealing opportunity for both residents and investors.

The countless reports of cost-of-living crisis, skyrocketing energy bills and interest and inflation rates at record highs are all prompting households to question their property circumstances. Homeownership has traditionally been associated with security, both financial through historic house value appreciation and the certainty that comes with having a roof over one’s head. Given the changing demands of today’s population and economic challenges faced by the country, can we reconsider our attitudes towards housing and turn our attention to the security of rental accommodation instead?

Homeownership

All UK regions have witnessed significant growth in house prices over the last two decades, which explains why residential property continues to appeal to would-be owner-occupiers. According to Land Registry data, an average UK property rose over 150% in value between August 2002 to August 2022.

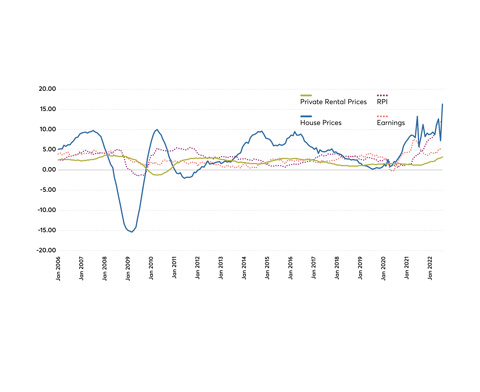

Historically, the financial benefit to all homeowners during this period, at least in headline terms (not accounting for mortgage interest rates and property upkeep etc.) has been meaningful and helped to fuel the aspiration for homeownership. Under-supply, growth in households and widely available credit have also all pushed house prices above inflation since the 1990s. Yet analysing trends in property prices on a yearly basis, what is evident is how significant global and local economic events correlate with house price volatility as demonstrated in the graph below. For example, the Global Financial Crisis can be seen in the trough in prices during 2008, the plateau in values as a result of Brexit, a dip witnessed when transactions came to a halt during Covid-19, and more recently the instability due to current global factors including the war in Ukraine, fuel prices, interest rates, etc.

Rental performance

Rental performance

Trends in rental performance have been relatively consistent in comparison and notoriously stabilised over time, performing steadily through cyclical environments. The Office for National Statistics long-term rental growth tracker demonstrates that UK private rents had seen between c.1-3% annual growth in the previous 10 years. The average rental growth tipped over 3% in May this year. During the pandemic, residents were physically unable to move or change property and therefore this pent-up demand has in many ways led to pent-up rental growth, as can be seen in the latest upward trajectory. Re-lets and renewals since 2021 have fuelled the most significant rise in rental growth, and at the same time it is likely that this period captures the UK’s maturing BTR market, with rents shifting to a level which reflects the higher quality service and amenities on offer. When considering rental growth alongside earnings and the Retail Price Index (RPI is a useful pricing indicator and includes housing cost), wages are closely aligned with RPI. This makes logical sense, as people’s ability to pay more for accommodation over time must reflect their earnings. It is not possible to leverage against income to borrow rent in the same way as people can fund home purchases (more on this point to come…) Recently, one of the UK’s largest private landlords, Grainger, announced like-for-like rental growth of 4.5% in the 11 months to the end of August, its strongest rental growth seen in a decade. Grainger’s commitment to realistic prices that its customers can afford has in turn resulted in high occupancy levels, with over 98% retention. Whilst Consumer Price Inflation (CPI) hit a 40-year high of 10.1% in October, Grainger notes that its rental growth has been in line with wage inflation, i.e., people’s ability to pay. Data from Allsop Letting & Management reiterates this trend with an average of 5.9% year-on-year rental growth across its managed BTR portfolio, with average occupancy at 97.8% (October 2022). The continued shortage of supply and better-quality BTR product and service have helped drive this performance. With average private rents surging nationally compared to pre-pandemic times, and levels of occupancy high with demand continuing to outstrip supply, the rental sector has proven its resilience.

Demographic trends

There are well-documented drivers increasing occupier demand for all segments of the UK residential sector. Namely, continued population and household growth - an estimated increase of 6.3% in UK households and one-person households increasing by 8.3% over the last 10 years - creates demand for more properties. At the same time, chronic under-supply of housing hampered further by elevated construction prices (according to some developers, build cost inflation this year has been 15%+, steel alone costs 70% more year-on-year, ONS, 2022) and inflationary consequences of the war in Ukraine will likely slow down the delivery of new residential units, especially in the short-term, fuelling the supply-demand imbalance further. Whilst historically there had been exponential growth in capital values in most areas of the UK, recent fiscal events suggest that the market is likely to slow significantly. The latest Bank of England interest rate rise from 1.75% to 2.25% (at the time of writing this article) puts the Bank rate at its highest level for 14 years, and two-year fixed rate mortgages standing at more than 6% put pressure on borrowing; the previous Chancellor’s September mini-budget had already resulted in 40% of mortgage products being

withdrawn in the week that followed. On this trajectory, it is unlikely the latest announcement of stamp duty savings will improve the affordability of homeownership anytime soon. The impact of the reassessment of housing choices following the pandemic live-work experience is increasingly apparent, propelling the attractiveness of renting, not just by financial necessity but through personal choice. The growing demand for flexibility in an increasingly mobile and individualised society, particularly in the younger cohorts of residents, can’t be underestimated. When compared with owner-occupied housing, rental residential property does not require sizeable third-party financing or commitment to a long-term stay in a specific location, making such housing more appealing to the end-user.

Attractive rental returns

The share of rental residential transactions in the UK institutional sector has witnessed a major increase despite the pandemic uncertainty, with circa £2.5 billion invested into the BTR

market in the first six months of 2022 alone, and over 15% of all property transactions involving residential rental accommodation compared to c.6% in the period 2012-2014 as a reference (UBS, 2022). As the institutional residential market evolves, it will likely expand from flatted city-centre blocks with amenities into other associated sectors. Single-family rental (suburban housing) supply is now estimated to be at 21,000 homes, an increase of 44% over the past 12 months alone (BPF, 2022). All things considered, increasing occupier demand combined with moderate supply support a compelling rental growth story, especially against a backdrop of historic property market data where residential income has offered a stronger inflation hedge when compared with the commercial real estate market average. Investors have arrived and they are here to stay.

Related Insights

Winner of Property Manager of the Year at the RESI Awards 2025

Congratulations to every member of our team for their dedication in delivering outstanding service and creating communities t...

Allsop Letting & Management wins three Homeviews Resident Choice Awards 2025

The team is absolutely thrilled to have been named the Top Rated Single Family Housing Operator for the second consecutive ye...

Meet Reece who is helping to make a Build to Rent community feel like a home

Reece has been nominated for Resident Team Member of the Year at the Homeviews Resident Choice Awards 2025.

Allsop Letting and Management appointed to run Birmingham’s tallest building and first skyscraper

Allsop Letting and Management (ALM), one of the UK's leading providers of professionally managed properties and a subsidiary ...