Blog | Valuation | Retail

Smart convenience stores = retail property revolution

London’s Holborn is primarily known for its high concentration of law firm offices and diamond shops per square

mile. Lately, the area seems to have assumed an additional identity, with numerous smart convenience stores having sprung up all around it.

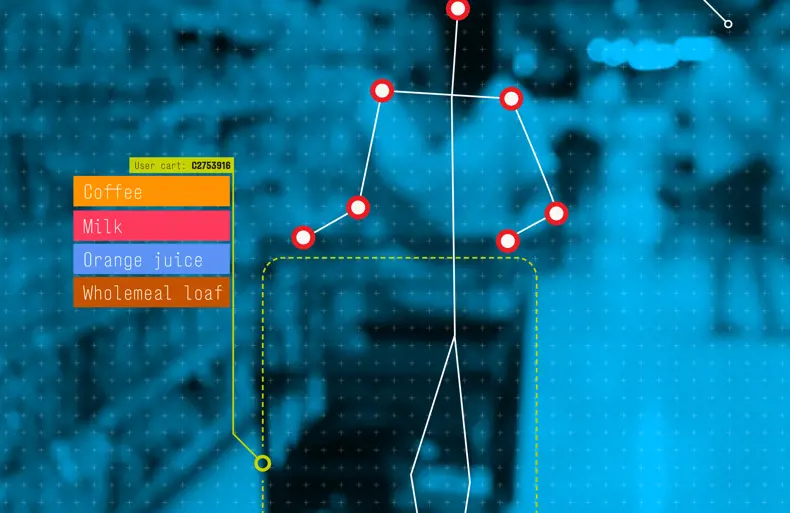

In the past 18 months alone, Sainsbury’s, Amazon Fresh and Tesco have launched checkout-free stores in Holborn. These shops feature autonomous technology which means shoppers can enter, identify themselves via a QR code, pick up desired products for purchase and walk out, without ever having to tap their contactless cards, let alone queue.

The rollout of these new technologies is starting to have an impact on our day-to-day lives, but what are their implications for the property market?

According to some estimates, the fit-out cost for a smart-powered retail property is more than £1m, double that of a conventional 3,000 sq ft convenience store, given the need to integrate numerous weight sensors, cameras and other

costly technological features from the very start. Given the size of the investment required, it is reasonable to assume that would-be tenants would seek longer leases, allowing them to reap the benefits of the new, ‘smart shopping’ format, which can take a while to materialise. This could be good news for those owning or looking to invest in retail premises in commercial districts, where time is of the essence. Areas like Holborn, as well as some parts of the City and Canary Wharf, have all seen footfalls increase as the pandemic subsided, making these areas desirable from an investment perspective, and being able to lock in well-capitalised tenants for longer further adds to their appeal.

Tangible benefits

Smart-powered stores are designed to help retailers reach a number of commercial objectives. Firstly, they minimise

queues, which often lead to customer frustration and cause people to leave stores empty-handed. Secondly, these stores reduce wage bills, with fewer people needed to run the shops at any single point in time. Thirdly, they minimise customer theft, which has been particularly problematic for shops relying primarily on self-checkout tills. An estimated £5.5bn is lost every year to shoplifting and employee theft – a significant enough sum to prompt retailers across the country to consider incorporating smart stores into their portfolios.

The social issue

While the benefits of this costly technology are at first glance clear from an investment perspective; the ease with which consumers will be able to adapt to it are less straight forward. Since the start of the pandemic, QR codes have

become ubiquitous, especially in larger cities, but their use is far from universal. Digital literacy is often taken for granted and it’s easy to forget that the elderly population may find the switch to apps and QR codes stressful and confusing.

In addition, not everybody owns a smart phone, essential for the next-generation shopping experience. Consequently Smart shops could very well remain confined to business districts, like Holborn, given their focus on serving time-poor and tech savvy people, albeit new stores have more recently opened in the outer London boroughs of White City, Camden, Ealing Chingford and East Sheen. Local convenience stores remain an important element of the social

fabric for many people, providing them with comfort and much-needed human interaction, and it’s not clear if they would be welcomed with open arms outside of urban areas.

Going back in time?

Some retailers in France, on the other hand, have been experimenting with radically different offerings – known as ‘bla bla’ cash registers, which are manned by friendly and, most importantly, chatty cashiers, where customers are encouraged to take their time when shopping specifically designed to provide customers, particularly the elderly, with a more rewarding shopping experience. Several big supermarket chains have set up ‘bla-bla’ cash registers in select locations, to target specific local demographics. While a niche offering that may not be ideal for fast-paced environments, it does have its proponents who view shopping from a social rather than utilitarian perspective.

Not a done deal

Smart stores are still a novelty for the UK market, and valuers recognise that not all buildings are suitable to house smart stores. The premium in rental value is likely to be attributed to the shape of the unit, the lack of physical

intrusions, such as structural columns and most importantly of all, the micro location. These are the fundamental characteristics that will determine the rental value. The capital value will be determined by the quality of the tenant, the inclusion of index linked rent reviews and length of lease. Will there be a premium attributed to an investment that includes smart technology? We are not aware of any smart stores having been traded, but we are starting to see more businesses embrace the power of tech, with Aldi opening a new tech-powered store in Greenwich earlier this year, while Morrisons has been trialling the new till-free model since last summer. It is a matter of time before we can understand the differences in investment value between conventional stores and smart stores. It is undoubtedly an attractive proposition, but we must not forget that old habits die hard and we, as humans, tend to treat new things with suspicion. If the retail industry is ready to go full steam ahead on the new offering, there might be a need for an educational campaign to get customers aboard the AI train.

Related Insights

What is happening to Ground Rents?

On 9th November 2023, the Department for Levelling Up, Housing & Communities (DLUHC) initiated a consultation process aimed a...

What might occur in the national investment market in 2024?

This time last year, our team of sector experts were hopeful of a more active market in 2023 – alas, with interest rates risi...

Podcast: Where would you invest £2.5m today? Q&A with George Walker

Join our podcasters Jack Robson and Ceara Duggan from Allsop's Leeds office, who give their “View from the 8th”(floor). In ...

Understanding The Key Proposals In This Landmark Bill: The Leasehold And Freehold Reform Bill

The Leasehold and Freehold Reform Bill, introduced to Parliament on 27 November 2023, is a significant piece of legislation t...